A growing number of Americans are discovering that their incomes no longer stretch far enough to cover basic needs. A recent economic analysis reveals that even full-time workers in many parts of the United States struggle to pay for housing, food, transportation, and healthcare. While employment rates have remained relatively high, wages have not kept pace with inflation or the rising costs of essential services.

The Cost of Living Outpaces Wages

One of the central issues facing Americans today is the mismatch between income and expenses. In cities like Los Angeles, New York, and San Francisco, rent alone can consume more than 50 percent of a person’s monthly income. Even in smaller cities or rural areas, housing costs are steadily rising. According to the National Low Income Housing Coalition, a full-time worker must earn over $25 per hour to afford a modest two-bedroom apartment in most U.S. states. Yet the federal minimum wage remains just $7.25 per hour.

Rising food prices further complicate the situation. The U.S. Department of Agriculture reports that the cost of groceries has increased significantly over the past two years, making it more expensive to feed a household. In many regions, basic food items such as eggs, milk, and bread have nearly doubled in price. For Americans living paycheck to paycheck, these increases are more than inconvenient. They are unsustainable.

Healthcare Costs Are Draining Household Budgets

Healthcare represents another growing financial burden. Even with insurance, out-of-pocket expenses like co-pays, deductibles, and medications can add up quickly. For uninsured Americans, a single medical emergency can lead to thousands of dollars in debt. The Kaiser Family Foundation reports that nearly half of all adults in the United States delay or skip medical care due to cost. This problem affects working-class families across the board, regardless of whether they have private or employer-sponsored coverage.

Prescription drugs, especially, are a significant strain. A report by AARP found that the average annual cost of medications for older Americans exceeds $12,000, which is more than the average annual Social Security benefit. Younger families are not immune either. Children with chronic conditions or even minor health issues can quickly rack up large medical bills. These realities underscore a system where basic health needs are often unaffordable, even for employed Americans.

Transportation Is a Hidden Expense

Many Americans overlook transportation when calculating living expenses, but it is a crucial part of the picture. Whether commuting by car, bus, or train, getting to work and essential services costs money. Gas prices have remained volatile, and vehicle maintenance is another expense that adds up over time. According to AAA, the average American spends over $10,000 per year on car ownership, including gas, maintenance, insurance, and registration fees.

Public transportation can be more affordable, but it is not always accessible or reliable. In cities without robust transit systems, workers may find themselves forced to buy and maintain vehicles just to hold a job. Rural Americans are especially affected, as job centers are often located miles from residential areas. Without reliable transportation, economic mobility becomes limited, trapping families in cycles of poverty.

Childcare Is Nearly as Costly as Rent

One of the most pressing financial challenges for working parents is childcare. A recent report from Child Care Aware of America found that in many states, the cost of center-based childcare for infants exceeds the average cost of in-state college tuition. In Massachusetts, for example, infant care can cost more than $20,000 per year. That is a significant burden for even middle-income families.

For single parents and low-wage workers, these costs often mean tough choices. Some leave the workforce altogether, while others rely on informal or unregulated care options that may be unsafe. Even with federal tax credits and subsidies, many Americans do not qualify for enough assistance to make a real difference. This forces families into difficult situations, affecting both their incomes and their children’s development.

Read More: 10 Early Warning Signs That a Recession May Be on the Way

Inflation Is Making Everything Worse

Inflation has become a dominant factor in the affordability crisis. While the rate of inflation has moderated in recent months, prices remain high for essential items. Rent, groceries, utilities, and other basics have not returned to pre-pandemic levels. For Americans whose wages have remained stagnant, the buying power of their income continues to decline.

The Consumer Price Index (CPI) shows that core inflation, which excludes volatile food and energy prices, remains elevated. That means long-term costs for housing, healthcare, and education continue to rise. Employers are slow to increase wages at the same pace, which leaves workers falling further behind. For many families, raises are barely noticeable after taxes and inflation take their share.

The Myth of the “Living Wage”

The concept of a “living wage” is often discussed but rarely implemented. The federal minimum wage has not increased since 2009, despite significant shifts in the economy. While some states and cities have raised their minimum wages, they still often fall short of what experts say is necessary for a basic standard of living.

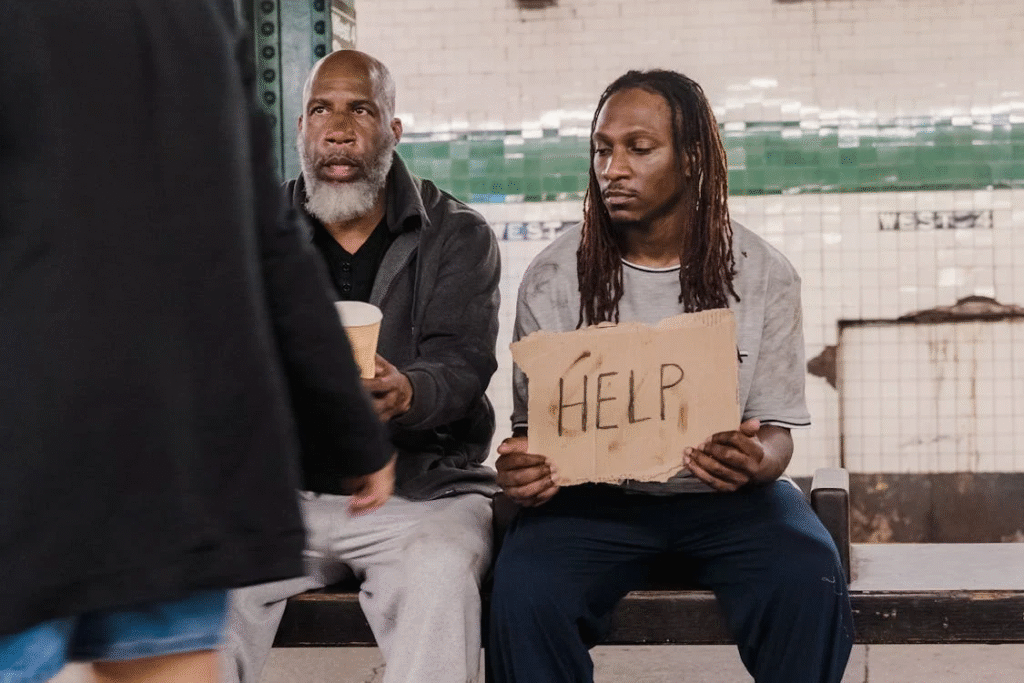

According to MIT’s Living Wage Calculator, a single adult with no children needs to earn at least $18 per hour in most parts of the U.S. just to meet basic expenses. That number rises significantly if children are involved or if the person is a single parent. Yet millions of Americans work jobs that pay far less than that amount. As a result, they are forced to rely on food banks, public assistance, or multiple jobs just to survive.

Public Assistance Programs Are Failing to Keep Up

While many Americans receive support from public assistance programs like SNAP, Medicaid, or housing vouchers, these systems are stretched thin. Eligibility requirements often disqualify those who need help the most, and benefits do not always cover the full cost of living. Long waiting lists for housing or childcare subsidies are common, and some programs are underfunded or subject to political changes.

Many working-class Americans fall into the so-called “benefits cliff,” where earning slightly more money disqualifies them from aid without making up for the lost support. This discourages economic progress and penalizes families for trying to improve their circumstances. In this way, the system is not just inadequate but actively counterproductive.

Housing Is No Longer Affordable for Most

Homeownership used to be considered a cornerstone of the American Dream, but it is becoming increasingly out of reach. Rising mortgage rates, inflated home prices, and stagnant wages have priced many Americans out of the housing market. According to Zillow, the median home price in the U.S. exceeds $400,000, while the average household income is under $75,000.

Even renting is becoming difficult. The U.S. Census Bureau reports that nearly half of all renters spend more than 30 percent of their income on housing, which is considered the threshold for being “cost-burdened.” In places with high demand and limited supply, landlords continue to raise prices, knowing tenants have few alternatives. Evictions are also on the rise, especially in urban areas.

Credit Card Debt Is Filling the Gap

To make ends meet, many Americans turn to credit cards or personal loans. This has created a debt spiral that is hard to escape. The Federal Reserve reports that credit card debt in the United States surpassed $1 trillion in 2024, with average interest rates climbing above 20 percent. Once a family starts relying on credit to pay for groceries, gas, or medical bills, it becomes difficult to recover.

This form of debt is especially damaging because it compounds quickly. A $1,000 expense can turn into a $2,000 burden within a year if payments are missed. Americans with limited savings or unstable employment are at the greatest risk, as even a small setback can lead to long-term financial damage.

Gig Work Is Not the Solution

While the gig economy has offered new income opportunities for millions of Americans, it is not a long-term fix for the affordability crisis. Many gig workers do not receive benefits like health insurance, paid time off, or retirement contributions. Their earnings are often inconsistent and dependent on external factors like demand, fuel prices, and platform fees.

Ride-share drivers, delivery workers, and freelancers frequently report that after deducting expenses, their take-home pay falls below minimum wage. Without labor protections, gig workers are vulnerable to sudden income losses or account deactivations. While gig work can supplement income, it rarely provides the stability or earnings necessary to afford basic costs of living.

Education Costs Continue to Climb

The cost of education is another barrier to economic security. College tuition has increased dramatically over the past two decades, leaving many Americans with significant student loan debt. According to the U.S. Department of Education, the average student loan borrower owes over $37,000. Monthly payments eat into already tight budgets, delaying milestones like homeownership or starting a family.

Even trade schools and community colleges, which are more affordable alternatives, have become more expensive. Meanwhile, financial aid does not always cover the full cost of attendance. Americans seeking to improve their earning potential through education often find themselves burdened with new financial obligations.

Retirement Savings Are Out of Reach

Planning for retirement is difficult when immediate needs are not being met. A large number of Americans have little or no savings for the future. The Employee Benefit Research Institute reports that nearly half of all households headed by someone aged 55 or older have no retirement savings at all. Without employer-sponsored plans or adequate wages, many people are forced to delay retirement or work well into their seventies.

This situation is especially dire for low-income workers, who are less likely to have access to pension plans or 401(k) programs. Even those who do have retirement accounts may struggle to contribute regularly. With inflation eating away at savings and the cost of living rising, preparing for the future becomes a luxury rather than a standard practice.

A Nation on the Brink of a Wage Crisis

The collective impact of these issues signals a broader wage crisis. Millions of Americans are employed, yet unable to afford basic needs like housing, food, healthcare, and transportation. This disconnect threatens not only individual well-being but also the long-term economic stability of the country. A workforce that is underpaid, overworked, and financially insecure cannot sustain national growth or innovation.

Policy changes are urgently needed to close the gap between wages and living costs. Increasing the minimum wage, expanding affordable housing, regulating healthcare prices, and supporting public transportation are just a few steps that could help. Until then, millions of Americans will continue to live on the edge of financial collapse.

Read More: Tariff Trouble: 22 Moments That Prove Many Americans Don’t Get It

Disclaimer: This article was created with AI assistance and edited by a human for accuracy and clarity.